Quick Links:

- Get a free stock worth up to $300 for signing up (no deposit necessary) for Robinhood with this link: Robinhood

- Get one free stock valued $2.50-$300 just for signing up (no deposit necessary) and get another free stock valued at $8-$2200 for making an initial deposit of $100 when you sign up with this link: Webull

- For Webull, in order to get your second free stock, your initial deposit must be at least $100, if you deposit, let’s say, $75 and then $25, you won’t get your second bonus stock.

- Get $50 to invest for free when you sign up and fund an account with at least $100 through this link: M1 Finance

- Get $50 for starting a Sofi Money account and depositing at least $500: Sofi Money

- Get $50 for starting a Sofi Investing account and depositing at least $5000: Sofi Invest

- Get $10 in a stock of your choice for signing up with Public and investing $100: Public

- Get $5 for starting an Acorns investing account and depositing any amount: Acorns

- By taking advantage of all these offers you can easily get $100+ for free! You can even just cash out once you get your bonuses if you don’t want to keep investing.

1. Robinhood

Robinhood Quick Facts:

- Get a free stock just for signing up and linking your bank account, no deposit necessary!

- Get 3 free stocks (limited time offer, usually 1 stock) for everyone you refer!

- Account verification process is very easy

- Very nice looking app

- Easy to use interface

- Easy to understand options trading

- Zero Commission Trades!

- Buy Bitcoin, Ethereum, DogeCoin and other cryptos

- Click here to get your free stock worth up to $300!

The first app I want to talk about is the one that started it all, Robinhood. This stock trading app is the first one I ever heard about and used. First of all, the app interface is super easy to use and the style looks sleek and modern. It’s really nice to look at and it makes viewing your stocks and profits fun.

One of the best things about Robinhood is how fast and easy it is for your account to be setup and verified, which makes it easy to get your initial free stock and free stocks from referral bonuses. You and your referrals don’t even need to deposit any money into their account in order to get the free stocks, which sets Robinhood apart from other apps. My account was verified instantly, and I got my free stock in about 5 minutes. My wife was also verified instantly without any problems. The free stocks you receive can be valued anywhere between $2.50 – $300. The ones I get are usually around $5 – 12. Refer your spouse, family, friends, and coworkers and build a free portfolio.

The app itself is very straightforward to use. Simply search for the stocks you want and pick how many shares you want to buy. On each stocks page you can see the stock’s performance history and general information about the company. You can even trade fractional shares, margins (margin trading is a premium feature), and they make trading options very easy to understand. The main page shows all of the stocks you own and your overall performance as well as any stocks you are tracking. There are premium account features like the aforementioned margin trading, instant deposits, and advanced analytics.

If you are new to investing, I would recommend Robinhood! Use this link to get your free stock now!

2. Webull

Webull Quick Facts

- Get one free stock valued $2.50-$300 just for signing up (no deposit necessary)!

- Get another free stock valued at $8-$2200 for making an initial deposit of $100!

- In order to get your second free stock, your initial deposit must be at least $100, if you deposit, let’s say, $75 and then $25, you won’t get your second bonus stock.

- Get two more free stocks for every person you refer that deposits any amount!

- Free stocks have a chance to be high valued companies like Google, Facebook, Starbucks, or Proctor and Gamble!

- Lots of promotions and contests for free stocks and prizes (like right now you can 7 free stocks for inviting 2 people)

- The app provides lots of information and analytics about each stock

- Community discussions about each stock and other investing topics!

- Low margin interest

- Zero Commission Trades!

- Bitcoin, Ethereum, DogeCoin and other cryptos also available

- Download here to get your free stocks!

The second app on my list is Webull. This app is similar to Robinhood overall but has a much different look and feel and some extra features. I believe one of the most important features Webull has compared to other apps is the advanced analytics (update: apparently these are available on the web version of Robinhood) that are available when viewing each stock. You can, for instance, view the RSI or MACD (plus many other indicators) over time against the stock price. Other useful features include:

- The ability to see other time & sales and volume analysis for each stock

- Discussion from other users about each stock

- Voting on whether a stock is Bullish or Bearish

- Advanced order types (Stop, Limit, Stop-limit)

- Paper trading (practice trading)

I feel like the interface for Webull is slightly clunky and confusing due to the amount of information on the screen, but you get the hang of it. It’s not as pretty as Robinhood, but the advanced features will keep you coming back especially if you are a more serious investor.

The community aspect of Webull is really cool. There are lots of discussions on various topics and for each stock as I mentioned before. When you vote on stocks to predict if it is bullish or bearish you get points if you are correct. You can use the points to enter contests. There are also contests for paper trading where you can win gift cards, student loan payoffs, or even a Tesla Model 3! If there are some strategies you want to try out, but don’t want to risk real money then give paper trading a try. Paper trading alone would be a good enough reason to own the app.

As for the signup and referral aspect, Webull was a little more rigorous with their identity check and it took a little longer to get approved. However, the rewards are the best because you will get one stock for signing up and another free stock for depositing any amount into your account. The first stock you have a 1/100 chance of getting a stock from a company like Google, Facebook, or Starbucks (Google is worth around $2200 currently). For the stock you get for an initial deposit over $100, you will have a 1/50 chance of getting one of these companies! Usually though, the value of your free stock is pretty good, at least $10. Some of the free stocks I got like Viacom are worth over $50 now!

When you refer someone, and they deposit any amount then you will get 2 free stocks that can be worth $12-$2200! There are even promotions where you can get even more stocks for a referral. A promotion from Jan. 13th, 2020 to Feb. 2nd, 2020, made it so you received 4 stocks for your first referral. You could just invite one family member or friend during this time and get an easy $48 at least! Download it here and signup to get your free stocks! I recently used another promotion to transfer my account from another brokerage and received 5 free stocks (they were worth about $75 in total)! Keep and eye out for promotions like this.

3. M1 Finance

M1 Finance Quick Facts:

- Create “Pies” made of many different stocks and funds.

- Easy portfolio diversification and less risk!

- Get $50 each time you refer someone else who funds an account with $100!

- Zero Commission Trades!

- Get $50 to invest for free when you sign up and fund an account with at least $100 through this link: M1 Finance

The last app, M1 Finance, is the one I’m most excited about and I’ve been using it more and more. This one works differently than the other apps I talked about before. The way it works is instead of buying shares of stocks like normal, you make “pies” made up of many stocks/ETFs/Mutual funds. Kind of like making your own mutual fund. You can choose how aggressive you want your portfolio to be or let M1 take care it. You can make multiple pies and chose how much you want to put in each one. It will manage the shares for you so you can have fractional amounts of shares in each piece of your pie.

For my first pie, just to try it out, I picked a bunch of tech stocks like Apple, Tesla, Microsoft, Amazon, some other random big-name stocks to diversify, some ETFs and mutual funds. So far it’s been doing very well. I am up almost $180 (about 35%!) from an investment of $600 in less than 6 months! I really recommend giving M1 a try since it’s very easy to make a diverse portfolio. Get $50 to invest for free when you sign up and fund an account through this link. You will also get $50 each time you refer someone else who funds an account, and sometimes they have promotions to get more!

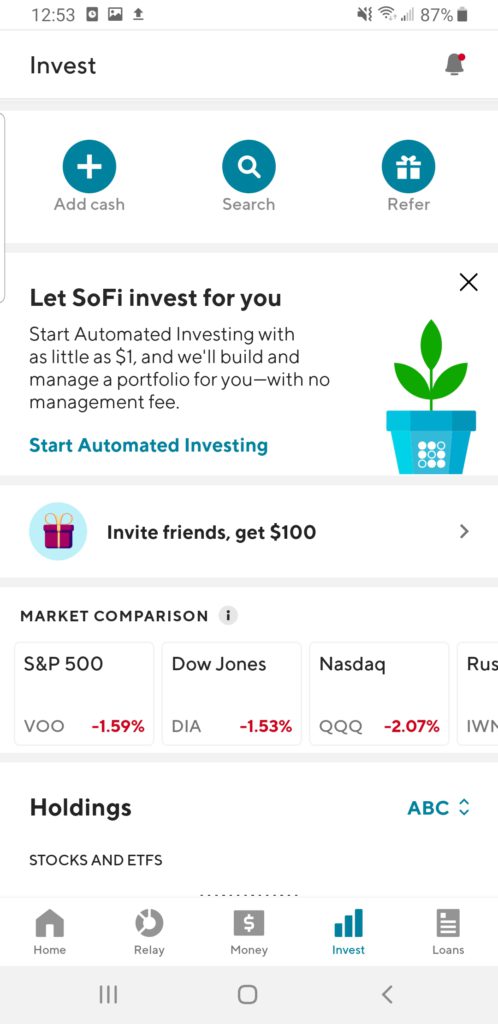

4. Sofi

Sofi Quick Facts:

$25 in free stock when you create an account and deposit at least $100!Offer expiredGet $25 if you refer someone who invests at least $100.Offer expiredGet $50 if you refer someone who invests at least $1000.Offer expired- Zero Commission Trades!

- New rewards system (since March 2021)

- Get $50 for an initial deposit of $5000 in your Sofi investing account (not as good as their old offers)

- Get $50 for starting a Sofi Money account (basically an online checking account) and depositing at least $500 (great deal) through this link: Sofi Money

- Click here to download!

SoFi, the third app on this list is another traditional no-fee stock trading app like Robinhood and Webull. It looks good and is pretty easy to use. There is an automatic investing feature that I haven’t tried yet and a savings account that will give you 1.60% APY. You can invest in fractional shares of stocks, what they call “Stock Bits”. Overall, it’s a good app, but there aren’t too many advanced features to talk about.

Most of their promotions for free money have expired or changed to where they aren’t as good. However, you can still get a free $50 if you start and investment account and deposit $5000. However, one good deal they currently have is to sign up for a Sofi Money account and deposit just $500. A Sofi Money account is basically just an online bank account. You can even use it to buy stocks in your investing account. So, getting $50 just to move some money here is a really good deal. Sign up for Sofi Money through this link to get your bonus: Sofi Money

Sofi has also introduced a rewards system recently, but I haven’t used it that much. However it seems like it has some potential to earn free money.

5. Public

Public Quick Facts:

- Follow your favorite investors, friends, or other people of interest

- See what other people are thinking about certain stocks

- Zero Commission Trades!

- $10 in a stock of you choice for funding an account with $100!

- Click here to download!

I just signed up for Public recently because they had an offer to get $10 in a stock of you choice for funding an account with $100. I haven’t used it much, but it seems pretty interesting. It’s an investing app with more of a social aspect. You can follow other people and see what they are invested in and also have discussions about certain stocks. For instance, you could follow the profile of a YouTuber who talks about investing or a popular analyst or even celebrities and see what stocks make up their portfolios. Sign up with my link and invest at least $100 to get $10 in a stock of your choice: Public

BONUS Investing App: Acorns

Acorns isn’t a free stock trading app, but it is an investing app and it is one I’ve been using for probably over 5 years. The main idea behind acorns is that it will round up the “loose change” from credit card purchases you make and invest it. For instance, if you buy something for $9.35, it will put the amount needed to get to the nearest dollar amount into your investment account — $0.65 in this case. This is an interesting way to invest because it really feels like your are accumulating your loose change. You can also just have Acorns invest a certain amount every week or however long.

You choose your investment strategy and portfolio much like you would a 401k or IRA. Acorns is seen as more of a long term investment. I’ve had good success with mine over the years and I am up over 20% by just setting my portfolio to aggressive and forgetting about it.

The app has other offers built into it too so it’s not just my extra money that is getting invested. For instance, I get $0.25 automatically invested into my account whenever I go to Chevron, because my credit cards are linked to the Acorns app. I’ve also signed up with Arcadia Power through the app which is a really cool service manages your home energy account and purchases renewable energy certificates on your behalf for free. Acorns invested $15 for me for signing up (a free $15 for helping the environment, yes please). There’s lots of other offers too like Uber, Airbnb, and Groupon.

Acorns has really good referral promotions every month like refer 4 people and get $1000 or refer 3 people and get $500! See here: https://www.acorns.com/ref-terms/

Other than that, the Acorns app looks really great and is easy to use. It’s the first app that got me into investing. Use my link and get $5 to start investing!

By the way, if you are interested in the Arcadia Power service I talked about above, you can get $25 for free by signing up through my link! It helps promote clean energy!

Bonus Investing Tip:

I’m still a novice investor, but one thing I do know is that you shouldn’t invest in a company without doing a little research. I don’t want to read financial documents and I probably wouldn’t even know what to look for. I recently found this great site, https://simplywall.st/, that will give an easy to read summary about any company you are interested in. It will break down a company’s risk factors in a beautiful list and even give you the source where it found the information. It also has good ideas about different markets to invest in. There’s tons of other information available too and it’s totally free to sign up! You get a two week trial where you can view unlimited stocks. After that, on the free plan, you can view 10 per month, which is usually good enough for me.

*Disclaimer*: This article is not financial advice. I wrote this from my perspective as a novice investor, so this is just the information I know. Even if you are a serious investor on other platforms, you can still use these apps to get free stocks and have some fun!